Purpose of AB 1212

AB 1212 aims to promote transparency and protect consumers, helping brokers feel trusted and accountable in high-risk hard money loans.

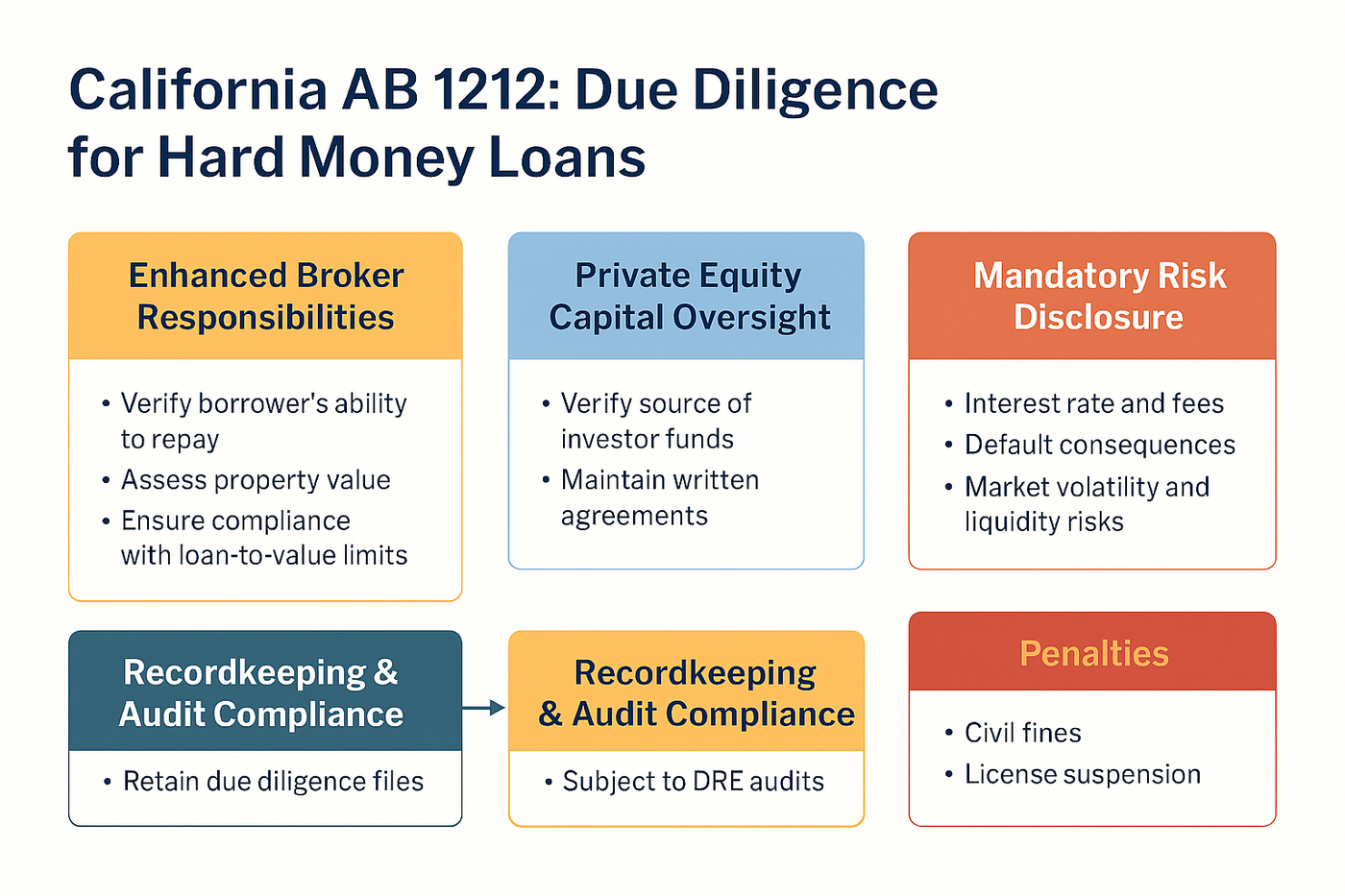

Key Provisions

· Enhanced Due Diligence Requirements for Brokers

· Real estate and mortgage brokers arranging hard money loans must:

· Verify Borrower’s ability to repay (income, assets, exit strategy).

· Assess property value through independent appraisal or valuation standards.

· Confirm compliance with loan-to-value (LTV) limits set by the bill.

· Disclose all material risks to both Borrower and investor.

· Private Equity Capital Oversight

· Brokers must document the source of funds and ensure investor capital is properly vetted.

· Maintain written agreements outlining investor risk, expected returns, and loan terms.

· Mandatory Risk Disclosure

· Provide borrowers and investors with a clear risk disclosure statement, including:

· Interest rate and fees.

· Default consequences.

· Market volatility and liquidity risks.

· Recordkeeping & Audit Compliance

· Brokers must retain due diligence files for a minimum period (likely 4–5 years).

· Subject to Department of Real Estate (DRE) audits and penalties for non-compliance.

· Penalties

· Civil fines and potential license suspension for brokers failing to meet due diligence standards.

Impact on Industry

- For Brokers: Increased compliance burden—must implement robust underwriting and investor verification processes.

- For Borrowers: Greater transparency and protection against predatory lending.

- For Investors: A clearer understanding of risks and safeguards for capital deployment.

✅ AB 1212 Compliance Checklist for Hard Money Loan Transactions

1. Borrower Due Diligence

- Verify Borrower’s ability to repay:

- Income documentation (tax returns, pay stubs).

- Asset verification (bank statements).

- Exit strategy (sale, refinance plan).

- Confirm Borrower’s creditworthiness and risk profile.

2. Property Valuation

- Obtain an independent appraisal or valuation report.

- Ensure compliance with loan-to-value (LTV) limits set by AB 1212.

- Document property condition and market comparables.

3. Investor Capital Verification

- Identify and document the source of funds for private equity capital.

- Maintain written agreements with investors outlining:

- Risk disclosures.

- Expected returns.

- Loan terms and conditions.

4. Risk Disclosure

Provide a clear written disclosure to the Borrower and the investor:

-

- Interest rate, fees, and total cost of the loan.

- Default consequences and foreclosure risks.

- Market volatility and liquidity risks.

-

Obtain signed acknowledgment from both parties.

5. Compliance Documentation

Maintain the due diligence file for each transaction:

-

- Borrower financials.

- Appraisal report.

- Investor agreements.

- Risk disclosure forms.

Retain records for a minimum of 4–5 years (per DRE audit standards).

6. Regulatory Filings & Licensing

- Confirm the broker license is active and in good standing.

- Ensure compliance with Department of Real Estate (DRE) audit requirements.

- Prepare for potential civil penalties for non-compliance.

Closing Statement

AB 1212 marks a pivotal shift in California’s oversight of hard-money lending, placing accountability squarely on real estate and mortgage brokers who facilitate these high-risk transactions. By mandating rigorous due diligence, transparent disclosures, and investor verification, the bill aims to protect borrowers from predatory practices and safeguard private equity investors from unnecessary exposure. For brokers, compliance is no longer optional—it is a strategic imperative. Those who embrace these standards will not only mitigate regulatory risk but also build trust, credibility, and long-term success in an increasingly scrutinized market. The message is clear: elevate your practices now to thrive in the new era of hard money lending.