Summary:

Assembly Bill 480 (AB 480), authored by Assemblymember Sharon Quirk-Silva and signed into Law in October 2025, updates California’s Low-Income Housing Tax Credit (LIHTC) program under the Personal Income Tax Law, Corporation Tax Law, and Insurance Tax Law. The bill introduces greater flexibility for developers and investors by reforming how state housing tax credits can be sold and allocated, aiming to unlock more private capital for affordable housing projects.

What AB-480 Changes

· Expanded Election Flexibility

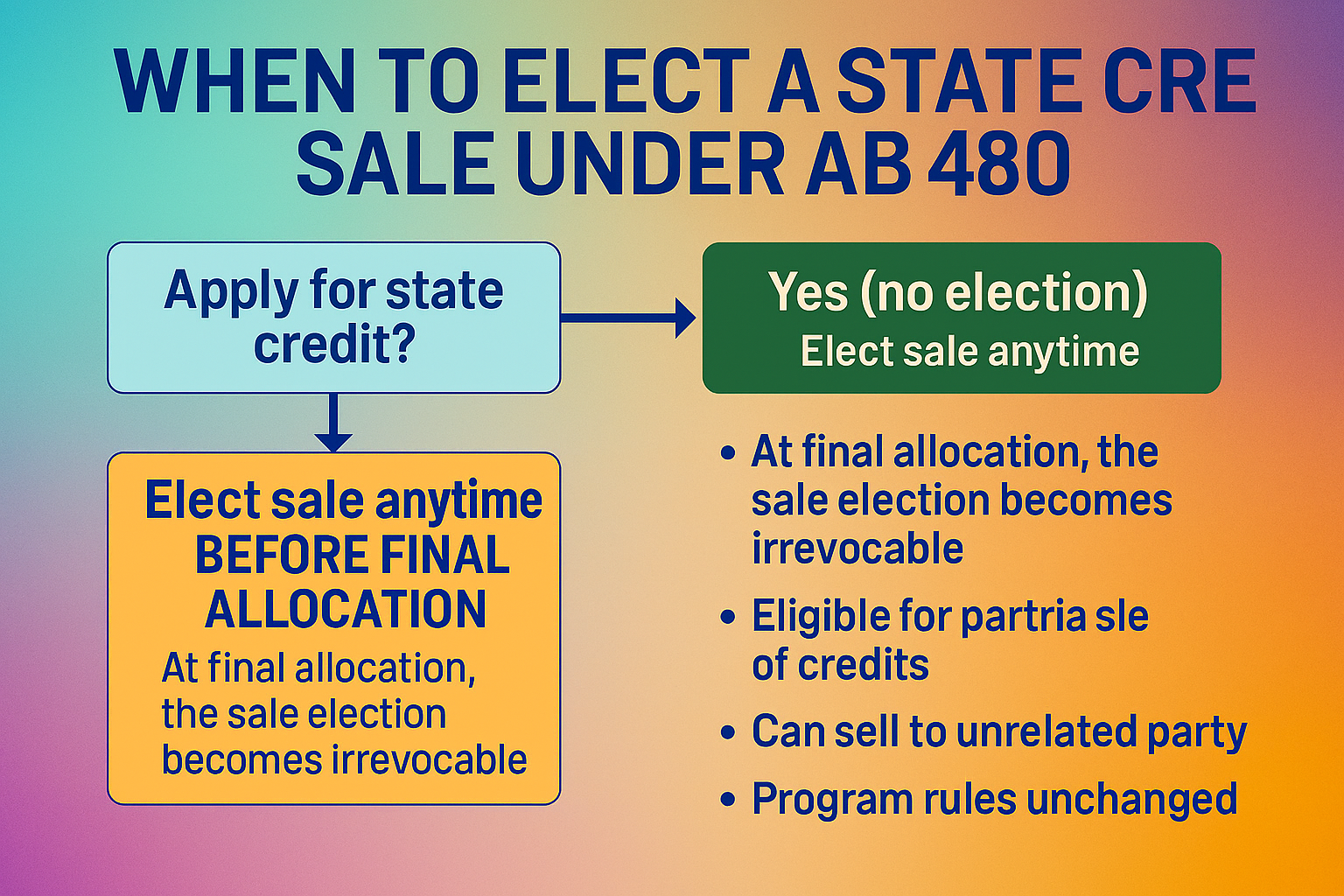

o Previously, developers had to elect to sell credits at the time of their initial application to the California Tax Credit Allocation Committee (CTCAC).

AB 480 allows taxpayers to make this election at any time before CTCAC allocates the final credit amount, giving sponsors more time to assess market conditions and their financing needs.

· Sale of Credits to Unrelated Parties

o Taxpayers can now sell all or any portion of their state LIHTC to one or more unrelated parties for each taxable year in which the credit is allowed.

o Sales must occur at no less than 80% of the value of the credit, ensuring integrity and preventing deep discounting.

· Certificated Credits

o Developers can opt for certificated credits, which function like a “tax gift card” and do not require ownership in the property, making them more attractive to corporate investors.

o Certificated credits typically command higher prices because they avoid federal tax complications tied to allocated credits.

· Reporting and Oversight

o Sellers must report details of the credit sale to CTCAC within 10 days and remain liable for compliance obligations tied to the credit.

- Boost Private Investment: By allowing more flexible credit sales and certificated options, AB 480 significantly increases the value of state credits, attracting corporate investors and reducing reliance on scarce public subsidies.

- Accelerates Affordable Housing Production: LIHTCs are the backbone of affordable housing finance. Enhancing liquidity and pricing power enables developers to close funding gaps more quickly.

- Supports Farmworker Housing: The bill maintains provisions for allocating credits to farmworker housing projects, a critical need in rural California. , ]

How the Program Works

- Federal vs. State LIHTC

- Federal LIHTC: Claimed over 10 years, covers 30–70% of project costs.

- California LIHTC: Claimed over 4 years, requires rents to remain affordable for 30 years (vs. 15 years federally).

- Both programs are administered by CTCAC, which allocates credits based on project feasibility and affordability commitments.

Effective Date

- AB 480 becomes operative on January 1, 2026, applying to projects that received a preliminary reservation from CTCAC on or after January 1, 2016.

Legislative Journey

- Introduced: 10 February 2025

- Passed Assembly: 2 June 2025 (79–0 vote)

- Passed Senate: 4 September 2025 (39–0 vote)

- Signed by Governor: 10 October 2025

Key Takeaways

- Developers can sell credits later in the process, not just at the application.

- Certificated credits increase investor demand and pricing.

- Applies consistently across personal income, corporate, and insurance tax Law.

- Expected to unlock millions in private equity for affordable housing statewide.