Summary

Payment Integrity, Program Design, and Political Incentives

Recent Federal Government calls for heightened federal scrutiny of California’s programs reflect a broader national challenge: protecting public funds in large, complex benefit and grant systems while avoiding policy responses that combine Fraud with improper payments.

Federal data show that improper payments remain a persistent, government-wide issue, while California-specific episodes—most notably pandemic-era unemployment failures and later prosecutions tied to homelessness and healthcare—illustrate recurring governance vulnerabilities in verification, oversight follow-through, and outcome measurement. This article reviews the evidence base and evaluates emerging proposals for centralized interagency coordination and strengthened controls.

1) Conceptual Baseline: Fraud vs. Improper Payments

Any policy discussion should begin with definitional clarity to maintain reader engagement. The Government Accountability Office (GAO) reports that improper payments are payments that should not have been made or were made in an incorrect amount; they can arise from overpayments, documentation problems, or recordkeeping errors. GAO also emphasizes that improper payments are not equivalent to Fraud—Fraud requires willful misrepresentation, though all fraudulent payments are improper.

This distinction matters operationally. Anti-fraud policy mixes two different toolkits: (1) Law enforcement and deterrence (investigations, prosecutions, recoveries), and (2) program integrity engineering (identity verification, eligibility checks, data matching, and payment controls). GAO’s framing implies that reducing losses requires both enforcement and systemic reforms, not merely stronger rhetoric.

2) National Context: The Scale of Payment Integrity Risk

GAO reported that federal agencies identified about $162 billion in improper payments in FY2024, with most of the estimate concentrated in a small set of programs. GAO also noted that the forecast is based on reporting across a subset of programs and agencies and that improper payment figures do not capture all possible vulnerabilities across the federal portfolio.

In this context, state-administered programs funded with federal dollars become focal points because they often combine: (a) high throughput; (b) eligibility complexity; (c) inconsistent data integration; and (d) political and administrative pressure to prioritize speed over verification in emergencies. California is not unique in these characteristics, but the state’s scale and recent History make it an especially salient test case.

3) California as a Case Study: Three Evidence Streams

3.1 Pandemic Unemployment: Controls Under Crisis Conditions

A California State Auditor report found significant weaknesses in the Employment Development Department (EDD)’s fraud prevention approach during the COVID-era unemployment expansions, including delays in implementing anti-fraud measures and substantial improper benefit payments tied to identity verification problems. The report describes EDD’s late automation of a key anti-fraud measure. It highlights payments subsequently flagged as potentially fraudulent due to unverified identities, as well as an estimate of the costs associated with incarcerated individuals.

From a policy perspective, the EDD episode illustrates a common trade-off in emergency programs: rapid disbursement reduces immediate hardship. Still, it can create a large attack surface when verification is postponed or relaxed. The question is not whether speed is ever justified, but whether systems are designed to preserve baseline controls even under crisis load.

3.2 Oversight Follow‑Through: Audit Recommendations as “Operational Debt.”

A CBS News California analysis of state audit recommendations dating back to 2015 reported that lawmakers failed to enact three out of every four recommendations requiring legislative action and identified more than 300 outstanding recommendations across a wide range of agencies and policy domains. This analysis highlights how delayed legislative action sustains vulnerabilities, emphasizing the importance of treating audit recommendations as operational debt to improve policy outcomes.

This points to a structural governance problem: audits can diagnose weaknesses, but implementation depends on sustained legislative and administrative attention—often in competition with other priorities. Treating audit recommendations like “operational debt” suggests a management approach with deadlines, transparent status tracking, and defined accountability for “no action” outcomes.

3.3 Program Exploitation in Housing and Health: Enforcement Signals

Two strands of enforcement activity are relevant to the current debate.

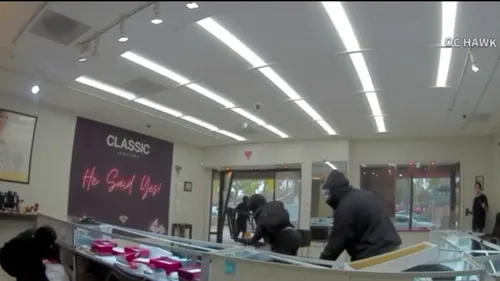

First, in October 2025, federal prosecutors announced cases involving alleged misuse of funds tied to homelessness housing initiatives, including claims that fabricated financial documents were used to obtain public funding associated with Project Homekey and that a project was not completed as intended. While these cases are not equivalent to statewide program fraud, they function as signal events: complex grant programs can be exploited when financial capacity claims and project performance are not validated with sufficient rigor.

Second, California DOJ public communications emphasize ongoing enforcement of healthcare fraud. In early February 2026, the Attorney General’s office announced arrests and felony charges in a hospice fraud case in Monterey County, alleging improper enrollment and billing practices with stated losses of about $3.2 million to Medi-Cal and Medicare. The state also describes broader enforcement outcomes and recoveries over a multi-year period, presenting an argument that California is actively pursuing Fraud rather than facilitating it.

4) Emerging Policy Proposals: Federal Coordination and Expanded Scrutiny

Reporting indicates two prominent lines of action from California’s Republican delegation: (1) requests for a broader GAO study of “waste, fraud, and abuse” in California; and (2) proposals to establish a federal fraud interagency task force intended to improve coordination among investigative entities.

The coordination rationale is not trivial. Fragmented investigation authority can increase duplication, slow referrals, and dilute accountability for outcomes (recoveries, prosecutions, and program fixes). However, the policy design details matter: task forces can become durable governance tools—or symbolic “announcement vehicles”—depending on data authorities, reporting requirements, and integration with program administrators who control eligibility and payment systems.

5) Analytical Assessment: What the Evidence Suggests (and What It Does Not)

5.1 What evidence supports

- Payment integrity risk is national, not state-specific: GAO’s FY2024 improper payment figure underscores a government-wide challenge.

- California exhibits recurring high-risk governance patterns, particularly under crisis conditions, in which verification and control systems were not resilient to surge demand.

- Implementation gaps persist: the audit follow-through problem suggests that identifying vulnerabilities is insufficient without structured mechanisms for closure.

- Enforcement is active: California DOJ reporting and recent hospice case announcements support the claim that state enforcement operations exist and are producing prosecutions and recoveries.

5.2 What evidence does not establish by itself

- A claim that Fraud is “tolerated” as a matter of official policy requires more than the presence of fraud cases. The cited materials more directly support a diagnosis of program vulnerability and oversight friction than a conclusion of governmental complicity.

6) Policy Recommendations (Design‑First, Enforcement‑Backed)

Recommendation 1: “Front‑load” verification for high-risk payments

In programs with recurring identity and eligibility vulnerabilities, shift from “pay‑and‑chase” toward prepayment checks where feasible: identity proofing, cross-matches, and anomaly detection before the release of funds. This recommendation follows directly from the State Auditor’s findings about delayed safeguards and verification weaknesses in unemployment benefits.

Recommendation 2: Convert audit recommendations into time-bound closure obligations

Publish a public ledger of audit recommendations requiring legislative action, with deadlines and periodic status updates. The CBS analysis suggests that inaction is a persistent issue and that greater transparency could enhance accountability and prioritization.

Recommendation 3: Pair interagency investigation coordination with program‑administrator responsibility

If a federal interagency task force is created, its mandate should include not only investigations and prosecutions but also closed-loop feedback to administrators (state and federal) so that exploited control gaps are remediated rapidly. GAO’s framing of improper payments as an enduring management issue supports the integration of oversight, data analytics, and corrective action rather than relying on enforcement alone.

Recommendation 4: Build performance measurement into homelessness and housing grants

Prosecutions tied to homelessness funding highlight the need for better verification of financial capacity claims and project delivery milestones. A policy approach would standardize milestone-based disbursement, independent validation of bank documents, and outcome tracking, thereby reducing incentives and opportunities to misrepresent readiness or performance.

Conclusion

California’s recent fraud-related controversies are best understood as a convergence of scale, program complexity, crisis-era administrative decisions, and uneven implementation of audit-driven reforms. The policy response most likely to reduce losses is neither purely punitive nor purely rhetorical: it is a combined strategy of front-end verification, transparent audit closure, and coordinated enforcement with rapid program redesign feedback loops.