Fractional Trust Deed Investors: Ownership as Tenants-in-Common

Summary

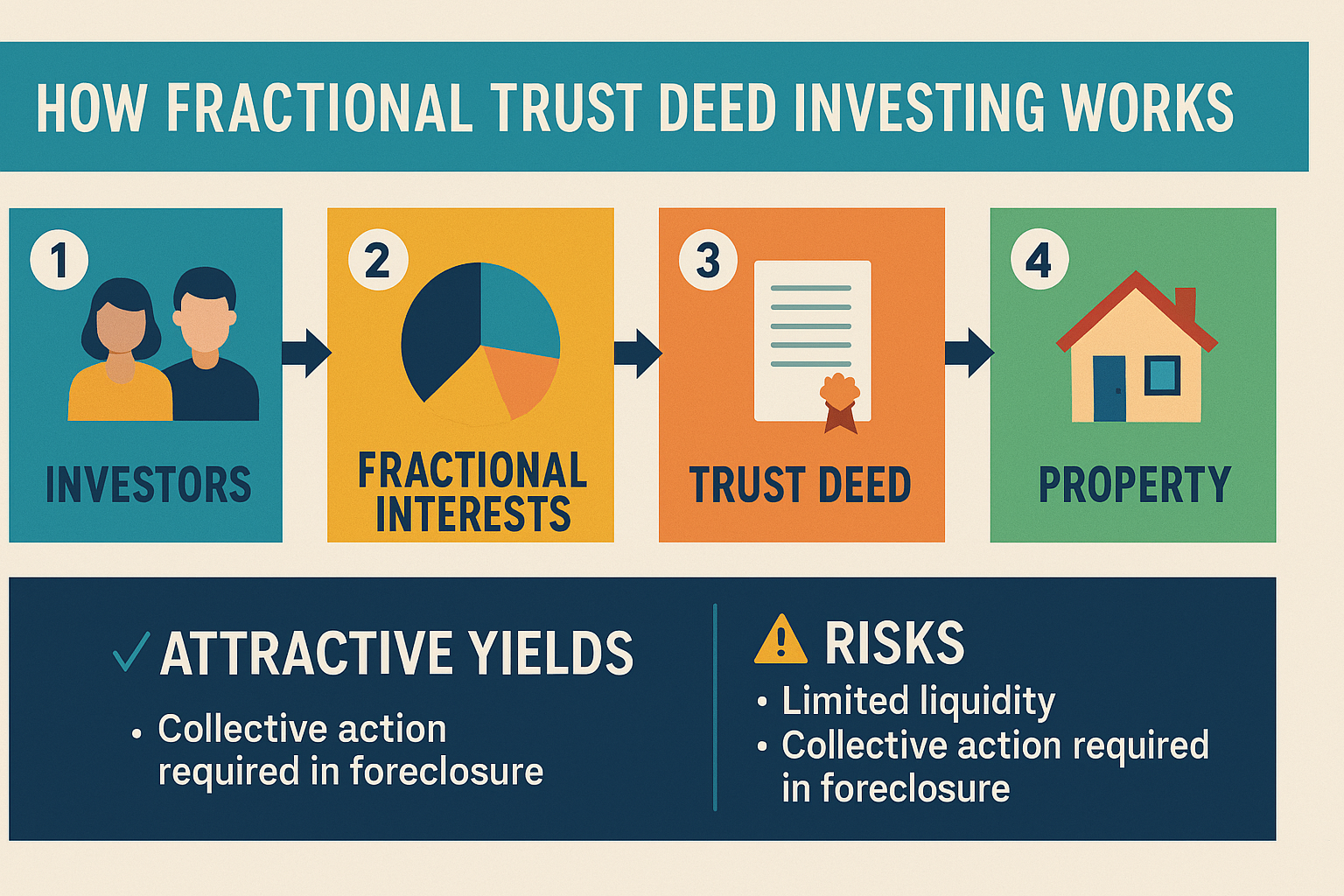

Private investors, your role in trust-deed investments is pivotal. Your capital fuels these transactions. Complex money loan brokers then structure and arrange real estate loan transactions, utilizing your funds as lenders. This ensures that each of you, as investors, receives a robust collateral package: a promissory note, a recorded deed of trust, and a title policy—all listing each Investor as a beneficiary. This structure is designed to secure each Investor’s investment and instill confidence in the process.

Trust deed investing, particularly fractional trust deed investing, is an attractive option for private parties like you. It offers compelling yields with relatively passive management. After reviewing a comprehensive disclosure package, you can decide based on your experience and risk tolerance, sign the necessary documents, and fund your investment. From that point forward, a professional loan servicer handles the day-to-day management, collects payments, monitors the loan, and distributes returns—allowing you to remain largely hands-off.

Fractional Ownership Explained

Investors can purchase either:

- A full interest in a promissory note and deed of trust (100%), or

- A fractional interest, teaming up with other investors as tenants-in-common.

With fractional ownership, you can tailor your participation to your financial capacity and risk preferences. This flexibility empowers you to make informed investment decisions, giving you control over your financial future and instilling confidence in your choices.

Example:

A $500,000 trust deed investment might include multiple fractional investors:

- Party A: $100,000 (20% undivided interest)

- Party B: $50,000 (10% undivided interest)

- Party C: $200,000 (40% undivided interest)

- Party D: $150,000 (30% undivided interest)

Diversification Benefits

An investor with $1,000,000 could place all funds into a single trust deed or diversify across 3–5 different loans. Diversification spreads risk and can enhance returns, as each loan involves a different property and Borrower profile.

Role of Brokers

Brokers are pivotal in trust deed investing. They source loans from borrowers and present them to private money brokers, who maintain relationships with investors. These private money brokers act as fiduciaries for investors, while originating brokers represent borrowers. The originating broker typically does not have direct access to investors; instead, it functions as a subagent, connecting borrowers to capital through a private money broker. Understanding this structure helps investors feel informed and confident in the process. The originating broker is responsible for ensuring that the Borrower meets the necessary criteria and is a suitable candidate for the loan.

Regulatory Framework

Deeds of trust create a security interest in real property, and fractionalized investments must comply with exemption rules under California Law:

- Single Investor (100%): Governed by 25100(p) of the Corporate Commissioner’s Rules.

- Up to 10 Investors: Governed by 25100(e) or 25102.5 of the Business and Professions Code.

- Under 25100(e): Brokers must provide an offering circular, disclosure documents, subscription agreements, and investor suitability standards for each transaction.

- Under 25102.5: Disclosure requirements align with B&P Code 10237, 10238, and 10232.5, including lender-purchaser disclosures.

- More than 10 Investors: Requires the 25012(f) private offering exemption.

Brokers should consult legal experts specializing in securities and real estate Law to ensure compliance.

Risks of Fractional Trust Deed Investing

· Foreclosure Complexity

If a Borrower defaults, all fractional investors must collaborate to initiate foreclosure. Disagreements among investors can delay action and increase costs.

· Liquidity Constraints

Fractional interests are not easily sold. Investors should expect to hold their position until the loan matures or is paid off.

· Borrower Default Risk

Even with substantial collateral, market downturns or property-specific issues can lead to losses.

· Servicing and Communication Issues

Transparent and professional loan servicing is crucial. Any lack of transparency can lead to confusion and payment delays, which is why it’s essential to work with brokers who prioritize clear communication and compliance.

· Regulatory Non-Compliance

Failure to adhere to exemption rules can expose brokers and investors to legal liability.

Best Practices for Investors

- Perform Due Diligence

Performing due diligence is not just a recommendation; it’s a responsibility. Review the Borrower’s financials, property valuation, and loan terms thoroughly before investing to ensure you’re making informed decisions and protecting your investment. - Understand Your Rights

Know how decisions are made among fractional investors, especially regarding foreclosure or loan modifications. - Work with Experienced Brokers

Choose brokers who understand compliance requirements and have a track record of successful transactions. - Diversify Investments

Spread capital across multiple trust deeds to reduce exposure to any single Borrower or property. - Plan for Illiquidity

Invest only funds you can afford to keep tied up for the loan term. - Verify Servicing Arrangements

Ensure the loan servicer is reputable and provides regular reporting.

Closing

Fractional trust deed investing isn’t just an alternative; it’s a strategy for investors seeking security, flexibility, and consistent returns. With professional management and real property collateral, you can diversify your portfolio and generate passive income without the complexity of owning real estate.