Summary

There is a structural shift in remote work that is here to stay. Technology has made it possible, so the need to be in an office is somewhat of an obsolete concept.

Here’s the current picture:

https://www.commercialedge.com/blog/national-office-report-january-2025/

https://dnyuz.com/2025/09/03/10-of-the-tallest-empty-skyscrapers-around-the-world/

https://perry.house.gov/news/documentsingle.aspx?DocumentID=402694

1. Vacancy Rates Remain Historically High

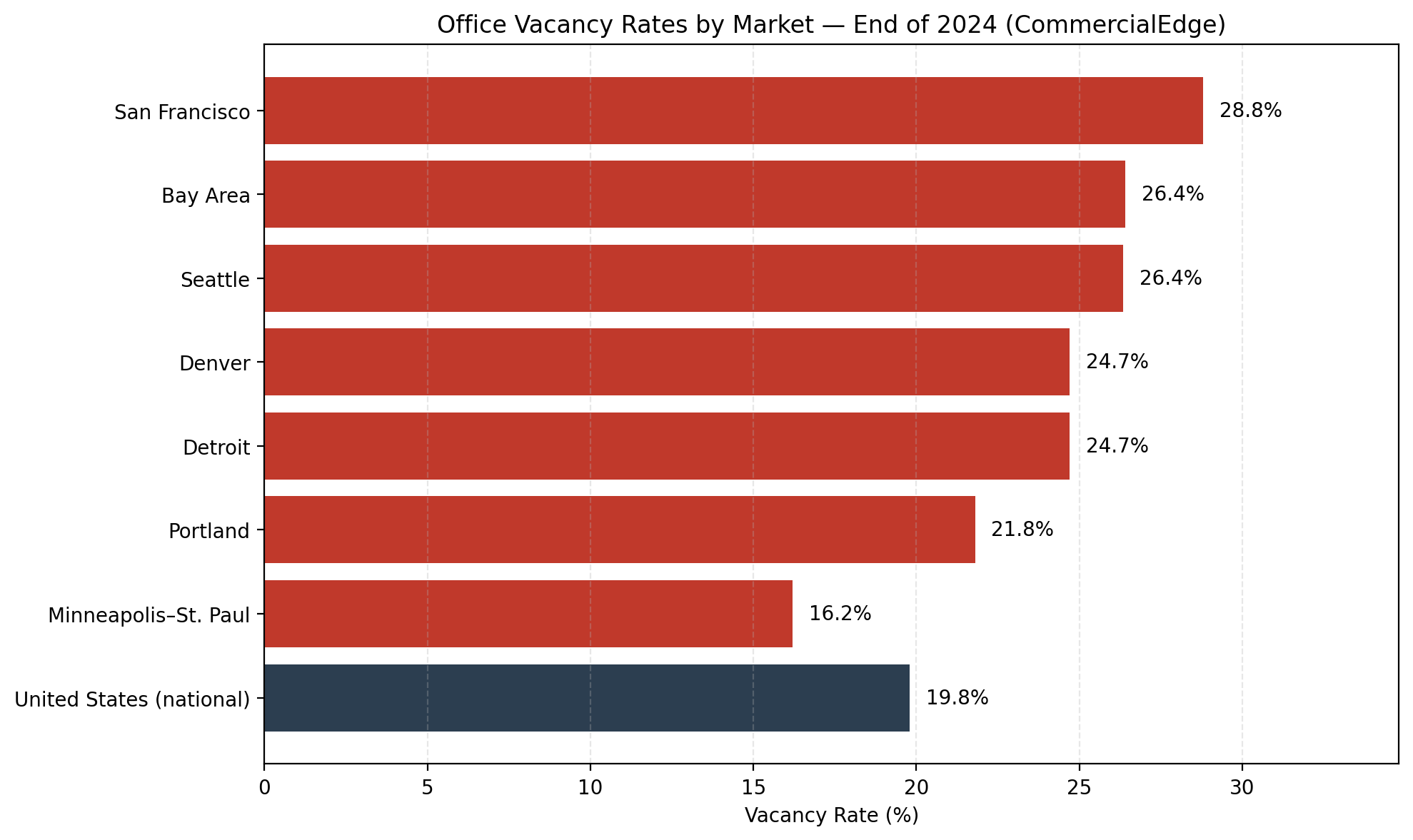

- The national office vacancy rate is around 19%, near a 40-year high. In some major cities, it’s much worse:

- San Francisco: ~31.2% (highest among major markets)

- Los Angeles: ~26.2%

- New York City: ~20%+

- Miami: ~11% (one of the lowest)

Across 15 leading markets, the average vacancy rate is 20.6%, up slightly from last year

2. Oversupply and Obsolete Buildings

- The glut is driven by an excess supply of outdated office buildings and a structural shift to hybrid work. Many older Class B and C buildings are struggling to find tenants, while demand for high-quality Class A space remains relatively strong.

Over 900 million square feet of office space is currently unused nationwide

3. Remote & Hybrid Work Impact

- Remote work adoption remains high, with 93% of workers seeking remote options, and many companies are downsizing their office footprints. Experts expect office space to stay 13% below 2019 levels by 2030, with worst-case scenarios predicting a reduction of up to 38%.

- This has led to falling property values—NYC office values are projected to remain ~39% below 2019 levels through 2029

4. Market Adjustments Underway

- For the first time in 25 years, U.S. office supply is shrinking as developers demolish obsolete buildings or convert them into apartments. In NYC alone, 40 million sq. ft. is slated for residential conversion over the next decade.

Construction of new office space has slowed dramatically, with 2025 expected to have the lowest completions in over a decade.

5. Signs of Stabilization

- Leasing activity is improving, and net absorption turned positive for five consecutive quarters as of mid-2025, though recovery is uneven and concentrated in prime locations.

Class A buildings in prime markets are performing better, while older stock faces obsolescence.

Bottom line: The office glut remains severe, particularly in central urban cores such as San Francisco and Los Angeles. However, conversions, demolitions, and a “flight to quality” are slowly rebalancing the market. Full recovery will likely take years and depend on how hybrid work trends evolve.

Data & scope: San Francisco (28.8%), Bay Area (26.4%), Seattle (26.35%), Denver (24.7%), Detroit (24.7%), Portland (21.8%), Minneapolis–St. Paul (16.2%), and the U.S. national baseline (19.8%). All values represent vacancy rates as of December 2024 from CommercialEdge’s national office report.