Summary

The primary difference is regulatory approval: an admitted carrier is licensed and regulated by the state, meaning its policies, rates, and financial stability are approved by the state’s Department of Insurance. In contrast, a non-admitted carrier is not licensed in that state and therefore offers more flexibility in policy terms and conditions for specialized or high-risk coverage but lacks state guarantee fund protection if the insurer becomes insolvent.

✅ Admitted Insurance Carriers

- Licensed by the California Department of Insurance (CDI)

They meet all state regulations for policy forms, rates, and claims handling. - State Guaranty Fund Protection

If the insurer becomes insolvent, the state guaranty fund will pay covered claims up to certain limits, providing a sense of security and peace of mind. - Consumer Protections

Policyholders can appeal to the CDI if a claim is mishandled, ensuring they are protected and their rights are upheld. - Lower Fees and Taxes

Policies generally avoid surplus lines taxes and fees, providing a financial advantage to policyholders. - Limitations

Less flexibility—usually, only standard risks are covered.

❌ Non-Admitted Insurance Carriers (also called Surplus Lines)

- Not Licensed by the State

They operate under surplus lines regulations, not standard state insurance rules. - No State Guaranty Fund

If the insurer fails, the state will NOT cover unpaid claims. - Greater Flexibility

• Non-admitted carriers offer greater flexibility, allowing them to insure high-risk or unusual exposures that admitted carriers won’t cover (e.g., wildfire-prone properties, unique businesses). - Higher Costs

Policies often include surplus lines taxes and fees. - Consumer Risk

• Keep in mind that with non-admitted carriers, there is no right to appeal to the CDI for claim disputes, which can pose a risk to consumers.

Key Takeaway:

- Use admitted carriers for standard coverage and stronger consumer protections.

- Use non-admitted carriers when coverage is unavailable in the admitted market (e.g., high-risk properties, specialized businesses).

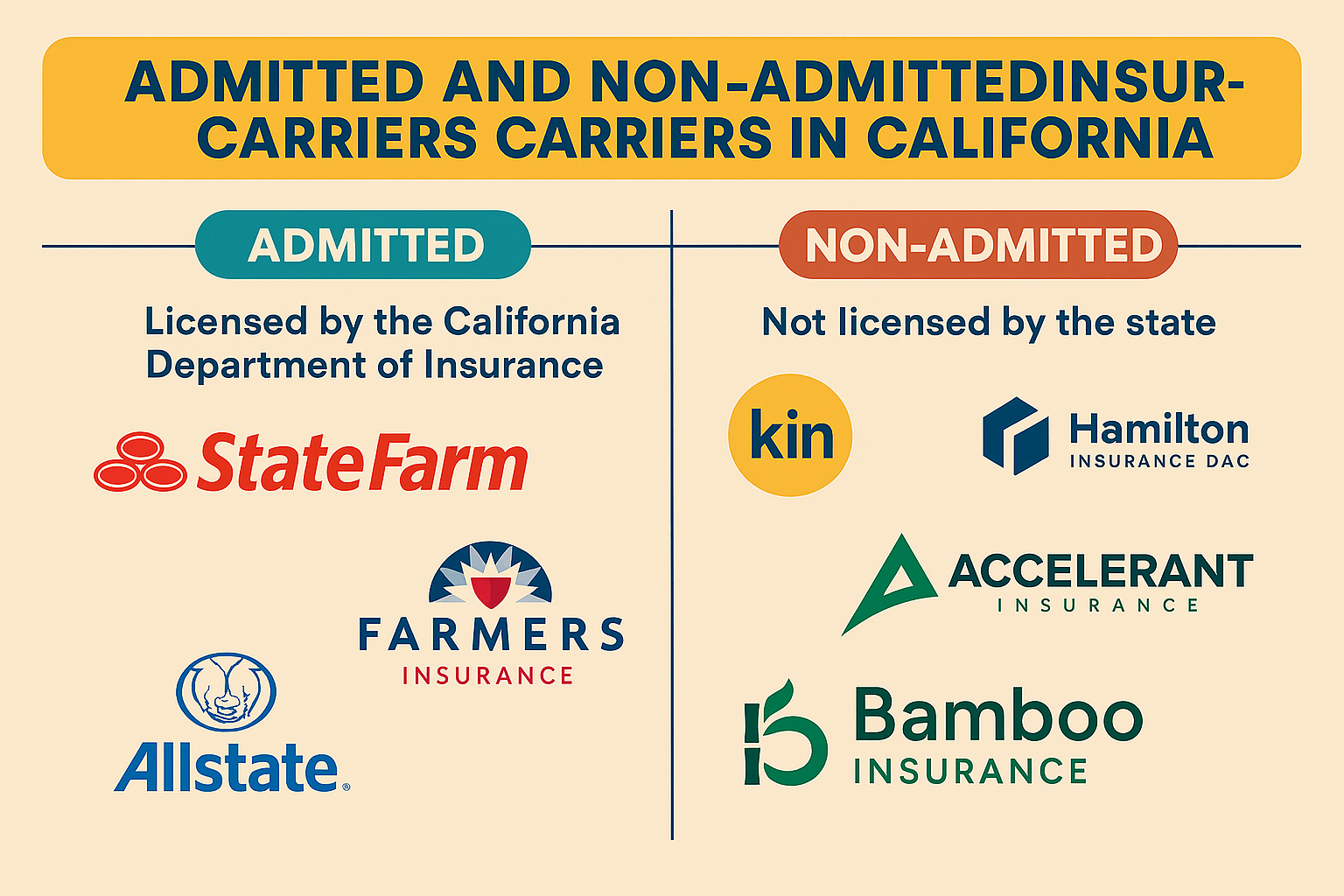

Here are examples of admitted and non-admitted insurance carriers in California:

✅ Admitted Insurance Carriers (Licensed by the California Department of Insurance)

- State Farm

- Allstate

- Farmers Insurance

These are well-established companies that comply with California regulations and participate in the California Insurance Guarantee Association (CIGA), which protects policyholders in the event that the insurer becomes insolvent.

❌ Non-Admitted Insurance Carriers (Surplus Lines)

- Kin Insurance – Specializes in high-risk areas, such as wildfire zones.

- Hamilton Insurance DAC

- Accelerant Insurance

- Bamboo Insurance (offers both admitted and non-admitted policies)

These carriers are not licensed by the state but are allowed to operate under surplus lines rules. They provide coverage for risks that admitted carriers often decline, such as homes in areas prone to wildfires.

Here’s what admitted insurance carriers can do that non-admitted carriers cannot in California:

✅ 1 Participating in the State Guaranty Fund

- Admitted carriers are part of the California Insurance Guarantee Association (CIGA), which protects policyholders in the event that the insurer becomes insolvent.

- Non-admitted carriers do not offer this protection, so policyholders bear the risk of insurer failure.

✅ 2. Use State-Approved Policy Forms

- Admitted carriers must use standardized, state-approved policy language to ensure consumer protection and consistency.

- Non-admitted carriers can customize policy terms, which offers flexibility but less regulatory oversight.

✅ 3 Offer Regulated Rates

- Admitted carriers’ rates are approved by the California Department of Insurance, which prevents discriminatory pricing and ensures fairness.

- Non-admitted carriers set their own rates without state approval, which can lead to higher premiums.

✅ 4. Provide Regulatory Recourse

- Policyholders with admitted carriers can appeal disputes to the California Department of Insurance.

- With non-admitted carriers, there is no state-level dispute resolution—issues must be handled privately.

✅ 5 Avoid Surplus Lines Taxes

- Admitted policies include standard state premium taxes, which are collected by the carrier.

- Non-admitted policies incur surplus lines taxes and fees, often making them more expensive.