Summary

Real property financing instruments vary by state. Some states use deeds of trust, while others use mortgages. • Deeds of Trust are common in states such as Alaska, Arizona, California, Colorado, Idaho, Illinois, Mississippi, Missouri, Montana, North Carolina, Tennessee, Texas, Virginia, and West Virginia. • Mortgages are required in states such as Connecticut, Delaware, Florida, Indiana, Iowa, Kansas, Louisiana, New Jersey, New York, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, Vermont, and Wisconsin. • Several states, including Alabama, Arizona, Arkansas, Illinois, Kentucky, Maryland, Michigan, Montana, and South Dakota, allow lenders to choose either instrument.

Real property financing instruments vary from state to state. Some states use deeds of trust, while others use mortgages.

· Deeds of Trust are common in states such as Alaska, Arizona, California, Colorado, Idaho, Illinois, Mississippi, Missouri, Montana, North Carolina, Tennessee, Texas, Virginia, and West Virginia.

· Mortgages are required in states such as Connecticut, Delaware, Florida, Indiana, Iowa, Kansas, Louisiana, New Jersey, New York, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, Vermont, and Wisconsin.

· Several states, including Alabama, Arizona, Arkansas, Illinois, Kentucky, Maryland, Michigan, Montana, and South Dakota, allow lenders to choose either instrument.

1. Deed of Trust Structure

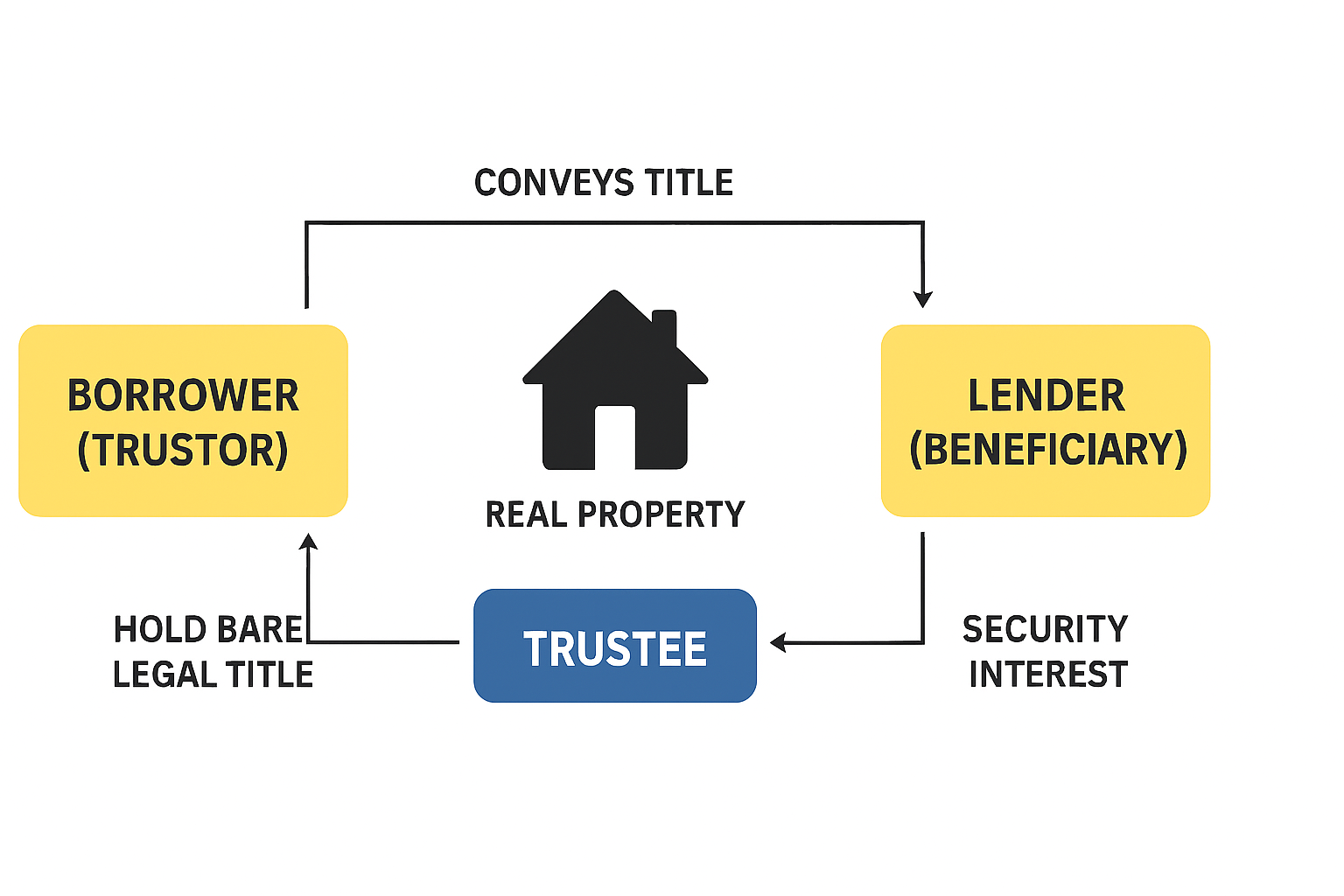

A deed of trust is a recorded security instrument tied to a promissory note that sets loan terms and repayment obligations. Under statutes such as California Civil Code §2936, this instrument involves three parties:

· Borrower (Trustor): Conveys title as security for the loan.

· Lender (Beneficiary): Holds the security interest and enforces repayment.

· Trustee: A neutral third party (often a title company) holding bare legal title to facilitate foreclosure if the Borrower defaults.

The trustee’s role is limited to enforcing the deed of trust upon default. Until then, the Borrower retains possession and control of the property.

2. Legal vs. Equitable Title

· Legal Title: Held by the trustee for security purposes.

· Equitable Title: Retained by the Borrower, granting rights of possession, use, and economic benefit.

3. The Trustee’s Role

The trustee acts as an impartial intermediary between the Borrower and the lender. Key responsibilities include:

· Holding Bare Legal Title: The trustee does not control or manage the property unless a default occurs.

· Foreclosure Authority: If the Borrower defaults, the trustee initiates and conducts the non-judicial foreclosure process according to state Law.

· Reconveyance: Upon full repayment, the trustee issues a deed of reconveyance, returning legal title to the Borrower.

· Neutrality: The trustee must remain independent and avoid conflicts of interest with either party.

Until default, the Borrower retains possession and control of the property, subject to the terms of the deed of trust.

4. Due-on-Sale / Due-on-Encumbrance Clause

Most deeds of trust include a provision allowing the lender to accelerate the loan if the property—or any legal, beneficial, or equitable interests sold, transferred, or further encumbered without prior written consent. Typical language includes:

“At the lender’s option, all sums secured by this Deed of Trust may become immediately due and payable upon any sale or transfer of the property or any interest therein, whether legal, beneficial, or equitable, without the lender’s prior written consent…”

This clause generally prohibits the Borrower from placing junior liens or otherwise encumbering the property without the lender’s approval, as the Borrower holds only an equitable interest subject to the deed of trust.

5. Lender Liability Considerations

Lenders face potential liability when enforcing deed of trust provisions or conducting a foreclosure. Common areas of risk include:

. Wrongful Foreclosure

· Occurs when a lender or trustee fails to comply with statutory requirements (e.g., Civil Code §§2924–2924k) or engages in fraudulent or oppressive conduct.

· Example: Failure to provide proper notice or violating California’s Homeowner Bill of Rights can lead to damages and attorney’s fees.

7. Improper Enforcement of Due-on Clauses

· Attempting to enforce an unenforceable due-on-encumbrance clause (especially on 1–4 unit residential property) may expose lenders to claims under state unfair practices laws or the FDCPA.

8. Misrepresentation or Bad Faith

· While lenders generally owe no fiduciary duty to borrowers, liability can arise for affirmative misrepresentations or bad faith conduct during loan servicing or modification negotiations.

9. Excessive Fees or Misuse of Assignment of Rents

· Courts have restricted improper charges and misuse of rents collected during foreclosure.

10. Risk Mitigation:

· Ensure compliance with federal preemption rules (Garn-St. Germain Act).

· Document Borrowerower communications.

· Follow statutory foreclosure procedures strictly.

· Avoid discretionary enforcement of clauses without a clear security justification.

11. Key Case Examples

· La Sala v. American Savings & Loan Assn. (1971) 5 Cal.3d 864

· Issue: Whether a lender could automatically enforce a due-on-encumbrance clause when the Borrower placed a junior lien on the property.

· Holding: The California Supreme Court held that automatic enforcement of such a clause constituted an unreasonable restraint on alienation unless the lender could show that enforcement was reasonably necessary to protect its security.

· Significance: This case established that lenders cannot accelerate a loan solely because of a junior lien unless they can demonstrate actual risk to their security interest.

· Tucker v. Lassen Savings & Loan Assn. (1974) 12 Cal.3d 629

· Issue: Whether a lender could enforce a due-on clause when the Borrower entered into an installment land contract.

· Holding: The court ruled that enforcement of the clause in this context imposed a significant restraint on alienation and was invalid unless the lender could show necessity to protect its security.

· Significance: Reinforced the principle that due-on clauses are not absolute and must be justified by legitimate security concerns.

· Wellenkamp v. Bank of America (1978) 21 Cal. 3d 943

· Issue: Whether automatic enforcement of a due-on-sale clause upon an outright sale was valid.

· Holding: The court concluded that such enforcement was an unreasonable restraint on alienation unless the lender could show that enforcement was necessary to protect its security.

· Significance: Extended the reasoning of La Sala and Tucker to outright sales, limiting lenders’ ability to accelerate loans without justification.

· Federal Preemption – Garn-St. Germain Act (1982)

· After these California cases, Congress enacted the Garn-St.. Germain Depository Institutions Act (12 U.S.C. §1701j-3), which essentially preempted state restrictions and allowed lenders to enforce due-on-sale clauses, with certain exceptions (e.g., transfers to a spouse or into a revocable trust).

· Impact: While due-on-sale clauses became broadly enforceable, due-on-encumbrance clauses remain unenforceable for 1–4 family residential properties under federal Law.