Summary

Friedman’s primary message was that Economic freedom is essential for political freedom, and stable control of the money supply is key to a healthy economy.

Milton Friedman- Memorable and powerful quotes:

https://www.goodreads.com/author/quotes/5001.Milton_Friedman

https://thequotescollection.com/famous-milton-friedman-quotes/

https://guides.loc.gov/milton-friedman

One of my most memorable reads was “Free to Choose: A Personal Statement” by Milton and Rose Friedman, a bestseller indeed.

1. On Government and Bureaucracy

· “If you put the federal government in charge of the Sahara Desert, in 5 years there’d be a shortage of sand.”

· “One of the great mistakes is to judge policies and programs by their intentions rather than their results.”

· “Government should be a referee, not an active player.”

· “Hell hath no fury like a bureaucrat scorned.”

2. On Free Markets and Capitalism

· “The world runs on individuals pursuing their self-interests. The great achievements of civilization have not come from government bureaus.”

· “The only way that has ever been discovered to have a lot of people cooperate voluntarily is through the free market.”

· History suggests that capitalism is a necessary condition for political freedom. Clearly, it is not a sufficient condition.”

3. On Freedom and Responsibility

· “A society that puts equality before freedom will get neither. A society that puts freedom before equality will get a high degree of both.”

· Inflation is taxation without legislation.”

· “Society doesn’t have values. People have values.”

· “Nothing is so permanent as a temporary government program.”

4. On Economics and Policy

· “The government solution to a problem is usually as bad as the problem.”

· “Higher taxes never reduce the deficit. Governments spend whatever they take in and then whatever they can get away with.”

· “The most important single central fact about a free market is that no exchange takes place unless both parties benefit.”

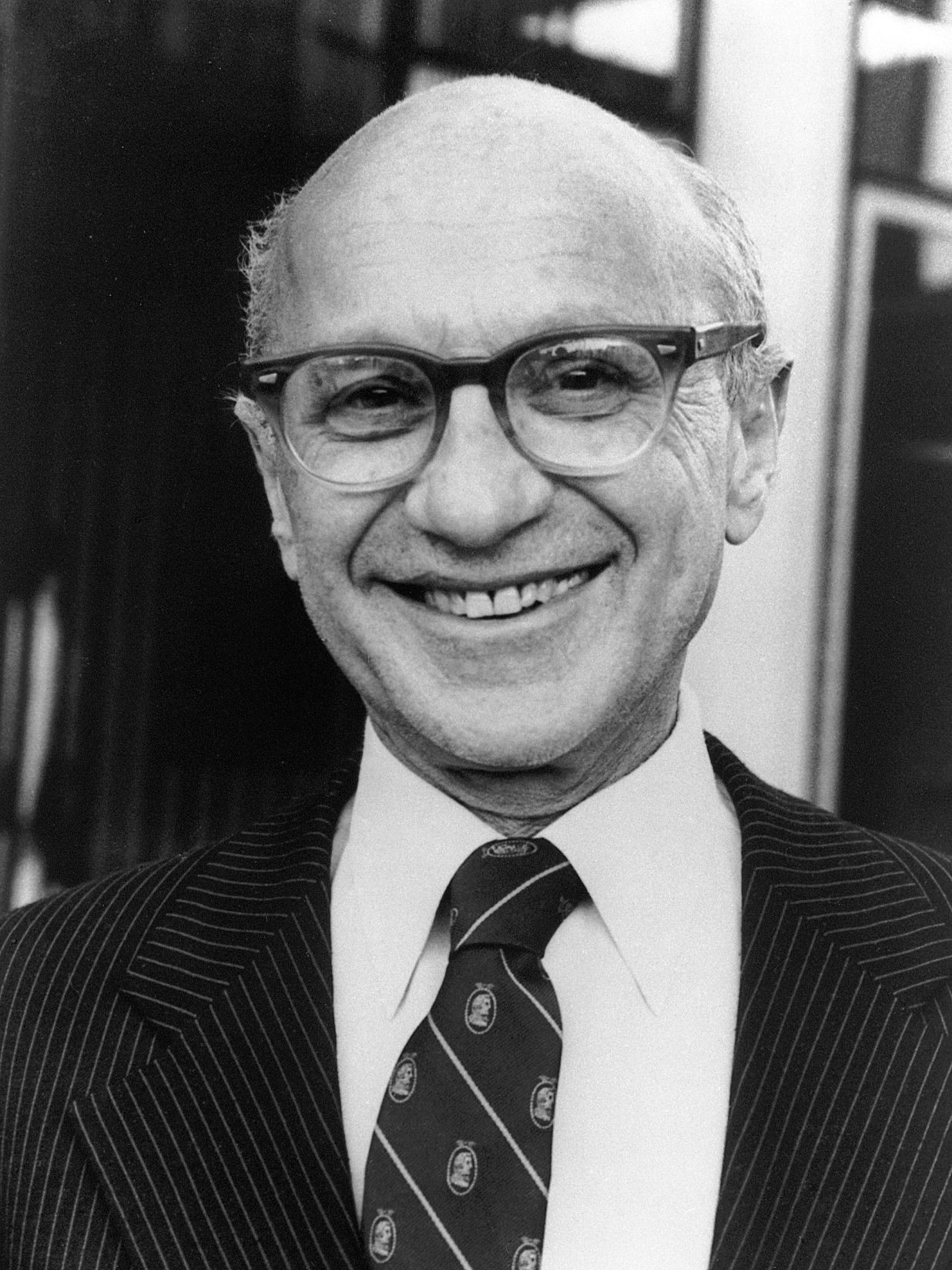

5. Biography and Academic Background

· Born in Brooklyn, New York, Friedman grew up in Rahway, New Jersey. He earned degrees from Rutgers University (B.A.), the University of Chicago (M.A.), and Columbia University (PhD).

· He taught at several institutions, most notably the University of Chicago, where he became a central figure in the “Chicago School” of economics

· He won the Nobel Prize in Economic Sciences in 1976 for his work on consumption analysis, monetary History and theory, and the complexity of stabilization policy

Major Economic Contributions

6. Monetarism

Friedman argued that changes in the money supply have profound effects on national output in the short term and on the price level in the long term. He believed that inflation is “always and everywhere a monetary phenomenon.”

The amount of money circulating in the economy is the primary driver of economic growth and inflation.

7. Permanent Income Hypothesis

In his 1957 book, A Theory of the Consumption Function, Friedman proposed that people base their consumption decisions on their expected long-term income rather than their current income, thereby challenging Keynesian assumptions.

8. Natural Rate of Unemployment

He introduced the concept that there’s a baseline level of unemployment that cannot be reduced without causing accelerating inflation. This challenged the Keynesian Phillips Curve, which suggested a stable trade-off between inflation and unemployment

9. Critique of Keynesian Economics

Friedman was a vocal critic of Keynesian fiscal policy, arguing that monetary policy was more effective and predictable than fiscal policy. His work contributed to the decline of Keynesian dominance in macroeconomics, especially after the stagflation of the 1970s

10. Friedman-Savage Utility Function

Co-developed with Leonard Savage, this model explains why individuals might simultaneously engage in risk-averse and risk-seeking behavior, such as buying both insurance and lottery tickets

11. Capitalism and Freedom

In his 1962 book, Friedman argued that economic freedom is a necessary condition for political freedom. He advocated for policies like school vouchers, a volunteer military, and deregulation

12 Corporate Social Responsibility

In a famous 1970 New York Times article, Friedman argued that the sole responsibility of business is to increase its profits, as long as it stays within the rules of the game

13. Sequential Hypothesis Testing

Outside economics, Friedman contributed to statistical methodology, helping develop sequential analysis techniques used in decision-making

14. Policy Influence

Friedman advised U.S. Presidents Nixon and Reagan, as well as UK Prime Minister Margaret Thatch. His ideas shaped global economic policy, especially in the 1980s, and influenced responses to the 2008 financial crisis.

Monetarism is an economic theory that focuses on the role of money supply in influencing the economy.

Here’s a simple breakdown:

15. Key Ideas in Simple Terms

· Money Matters Most

If there’s an excess of money in circulation, prices tend to rise, leading to inflation. Conversely, if there’s a shortage of funds, spending slows down, and the economy can contract.

If there’s too little money, spending slows down, and the economy can shrink.

· Control the Money Supply

Governments and central banks (like the Federal Reserve) should manage the growth of money supply carefully—not too fast, not too slow.

· Inflation Is a Monetary Phenomenon

Milton Friedman famously said:

“Inflation is always and everywhere a monetary phenomenon.”

· Less Government Intervention

Monetarists believe the economy functions best when the government refrains from intervening through constant spending or taxation. Instead, they should focus on stable monetary policy.

📊 Example

Imagine the economy is like a balloon:

· Too much air (money) = balloon inflates too fast = high inflation

· Too little air (money) = balloon shrinks = recession

✅ Positive Effects of Inflation Control

· Stable Prices

People and businesses can plan more effectively when prices don’t fluctuate wildly. This helps long-term investments and contracts.

· Stronger Currency

When inflation is low, the value of money stays more stable, which can boost confidence in the economy and attract foreign investment.

· Lower Interest Rates Over Time

If inflation is under control, central banks don’t need to raise interest rates aggressively, making borrowing cheaper.

· Protects Savings

Inflation erodes the value of money. Keeping it low helps people’s savings retain their purchasing power.

Uncertaintyuces Uncertainty

Predictable inflation makes it easier for businesses to set prices, wages, and budgets.

⚠️ Potential Downsides or Trade-Offs

· Slower Economic Growth

Tight inflation control (like raising interest rates or reducing the money supply) can slow down spending and investment.

· Higher Unemployment (Short-Term)

If inflation is controlled too aggressively, businesses may reduce their operations, leading to job losses.

· Debt Becomes More Expensive

With lower inflation, the real value of debt payments increases, which can hurt borrowers.

· Risk of Deflation

If inflation is pushed too low, prices may start falling (deflation), which can lead to economic stagnation.

🎯 The Goal

The ideal is moderate, predictable inflation—not too high, not too low. Most central banks aim for an annual inflation rate of around 2% as a healthy target.

📊 What the Chart Shows

· Interest Rates (%): Rise steadily as inflation control tightens—central banks often raise rates to slow inflation.

· Employment (%): Declines over time—higher interest rates can reduce business investment and hiring.

· Economic Growth (%): Slows gradually—tight monetary policy can dampen consumer and business spending.

🕒 X-Axis: Time (Years)

Represents a 10-year period during which inflation control measures (like raising interest rates) are gradually applied.

📈 Y-Axis: Economic Indicators

Shows how three key indicators change over time:

16. Interest Rates (%)

· It starts at 2% and increases by 0.5% each year.

· This reflects central banks’ tightening of monetary policy to control inflation.

· Higher interest rates make borrowing more expensive, which slows spending and investment.

17 Employment (%)

· Starts at 100% (a simplified whole employment level) and drops by 3% each year.

· As interest rates rise, businesses may cut back on hiring or lay off workers due to reduced demand.

· This shows the short-term trade-off between inflation control and job availability.

18. Economic Growth (%)

· It starts at 3% and declines by 0.2% each year.

· Higher interest rates reduce consumer and business spending, leading to slower GDP growth.

· This illustrates how tight monetary policy can cool down the economy.

19. Summary of Trends

|

Year |

Interest Rate (%) |

Employment (%) |

Growth (%) |

|

0 |

2.0 |

100 |

3.0 |

|

5 |

4.5 |

85 |

2.0 |

|

9 |

6.5 |

73 |

1.2 |