Summary

Understanding these illusions is the first step toward building resilience in an unpredictable environment, a crucial skill for business and finance professionals.

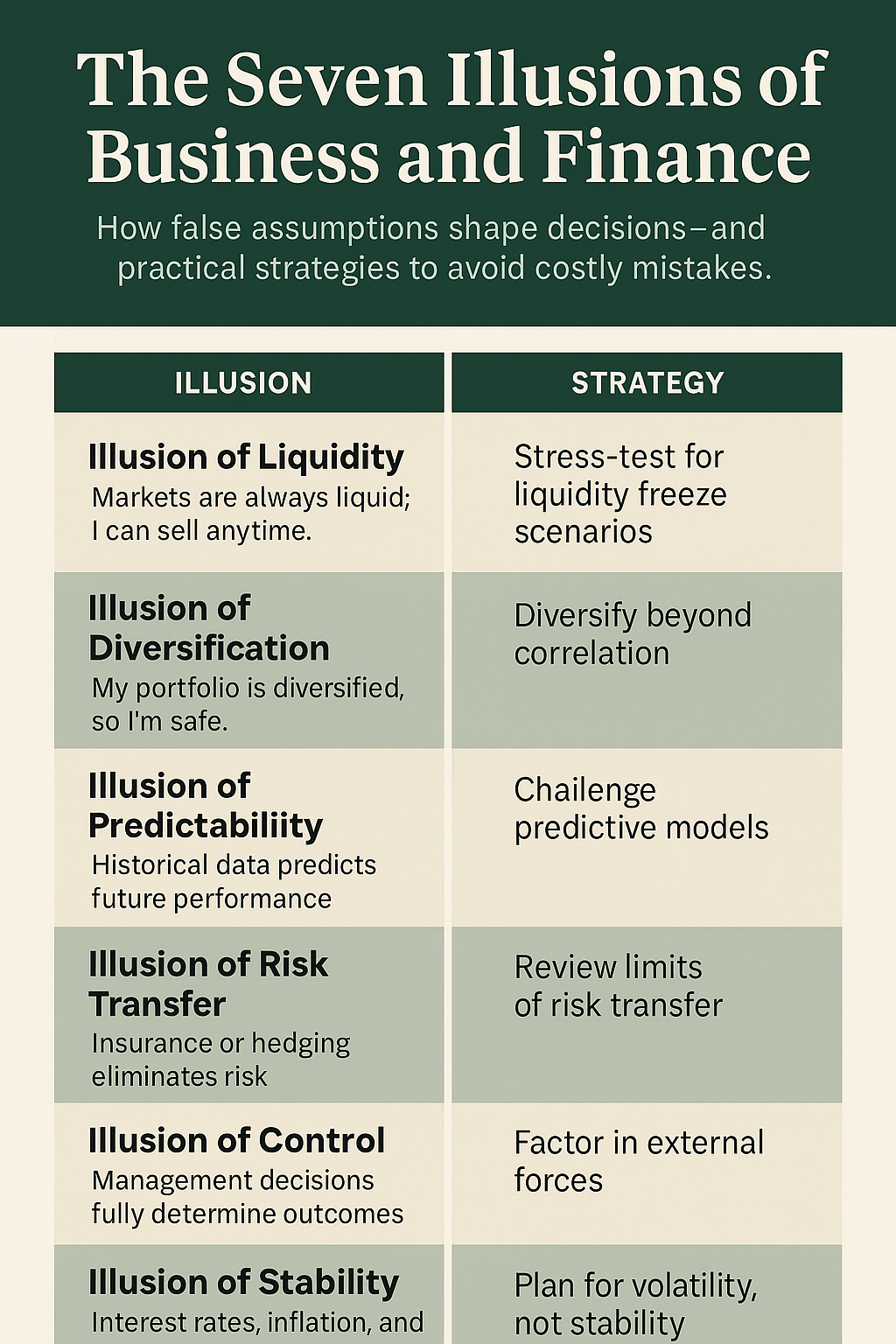

1. The Illusion of Liquidity

Belief: “Markets are always liquid; I can sell anytime.”

Reality: Liquidity is a fair-weather friend. In times of crisis—such as the 2008 financial meltdown or the early days of the COVID-19 pandemic—buyers vanish, and assets that seemed easy to sell become frozen.

Example: During the 2008 crisis, mortgage-backed securities that were considered highly liquid became virtually unsellable overnight.

2. The Illusion of Diversification

Belief: “My portfolio is diversified, so I’m safe.”

Reality: Diversification works—until it doesn’t. In systemic downturns, correlations spike, and assets that appeared uncorrelated suddenly move in the same direction.

Example: In March 2020, global equities, corporate bonds, and even some commodities all declined simultaneously, leaving “diversified” investors vulnerable.

3. The Illusion of Predictability

Belief: “Historical data predicts future performance.”

Reality: Past performance is not a guarantee of future results. Black swan events and structural shifts can render models useless.

Example: Long-Term Capital Management collapsed in 1998 despite using sophisticated models based on decades of historical data.

4. The Illusion of Risk Transfer

Belief: “Insurance or hedging eliminates risk.”

Reality: Risk is never eliminated—only shifted. Counterparty risk, policy exclusions, and systemic shocks can bring it back.

Example: A property owner may feel secure with insurance, only to discover that it excludes coverage for flood or earthquake damage after a disaster.

5. The Illusion of Control

Belief: “Management decisions fully determine outcomes.”

Reality: External forces—such as regulation, macroeconomics, and consumer sentiment—often dominate the results. This dominance underscores the need for adaptability and flexibility in business and finance, as it’s not just management decisions that determine outcomes.

Example: A well-run hospitality business can still fail during a pandemic due to factors beyond its control

6 The Illusion of Stability

Belief: “Interest rates, inflation, and credit conditions will remain stable.”

Reality: These variables are highly cyclical and influenced by unpredictable policy and global events.

Example: Businesses that borrowed heavily during the low-rate era of 2020–2021 faced severe stress when rates spiked in 2022–2023.

7. The Illusion of Value

Belief: “Book value or appraised value equals real value.”

Reality: Market value is the amount that someone is willing to pay today, which can significantly differ from accounting measures.

Example: Commercial real estate valuations plunged in 2023 as remote work reduced demand for office space, despite unchanged book values.

8. Why These Illusions Continue

Illusions persist because they provide psychological comfort and operational simplicity. They allow businesses to plan, investors to allocate capital, and managers to feel in control. But when reality intrudes, the cost of these illusions can be enormous.

9. Practical Strategies to Mitigate These Illusions

- Stress-Test Assumptions

- Run scenarios for extreme but plausible events (e.g., liquidity freeze, interest rate spikes).

- Use reverse stress testing: “What would break us?”

- Maintain Liquidity Buffers

- Keep cash reserves or access to credit lines.

- Avoid over-leveraging during boom periods.

Conclusion: Turning Awareness into Action

Recognizing these illusions doesn’t eliminate uncertainty—but it does create an edge. Leaders who challenge assumptions, stress-test scenarios, and maintain flexibility are better equipped to survive and thrive in volatile markets. In business and finance, the most significant risk isn’t uncertainty—it’s the illusion of certainty. By constantly challenging assumptions and maintaining flexibility, leaders can turn their awareness of these illusions into practical action.