Summary:

Buying now and paying later, typically through a credit facility (which involves debt), is a common practice in America. Credit facilities may include credit card purchases, term loans, extended buy-now-pay-later promotions, and government-issued fiat currencies. A fiat currency is a currency that a government has declared legal tender, but it does not have a physical commodity, such as gold or silver, backing it. The government creates fiat currency out of thin air and spends it on pet projects for political expediency, with no plan to repay it. Backed by the full faith of the U.S Government is nothing more than an illusion and should not be supported by a continuous Ponzi scheme.

Artice:

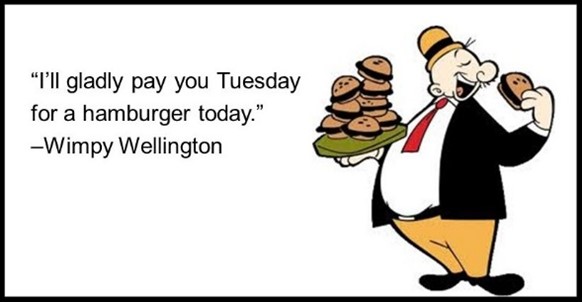

“I’ll Gladly Pay You Tuesday for a Hamburger Today.”

J. Wellington Wimpy, commonly referred to as simply “Wimpy,” was a character in the popular Popeye television cartoon series, which aired in the mid-20th century. Wimpy always requests something for free, claiming to be able to repay the debt on “Tuesday” or sometime in the future. Wimpy was brilliant and well-educated, but lazy, gluttonous, and greedy, readily willing to create a scam to get free food. Wimpy was simply a moocher and a parasite.

The American psyche has been indoctrinated into the illusion that things can be obtained for free, without any obligation to repay or extend credit to pay them back over time. Consuming now and paying later with someone else’s money is now the norm. Accumulation of debt rather than paying as you go is also the norm. A platform of gluttonous consumption has substituted the definition of "pursuit of happiness.”

Societies participants:

Children are born as sovereign individuals with natural and inalienable rights to look forward to. Each child is introduced to a country, a family, and socioeconomic circumstances. Some learn profusely to expand their knowledge, develop a positive frame of reference, and take advantage of the unlimited opportunities. Some do not.

Some grow up to be productive citizens, secure jobs, raise families, abide by society’s customs, rules, and laws, and contribute to the community by paying taxes. Some stay in their lane, drive the speed limit with seatbelts fastened and baby seats secured for the little ones, and remain ever vigilant about the dangers; some do not. Some are positive members of society by participating and paying their fair share, or more than their fair share. Others are not.

Some grow up as economic losers and only benefit by taking from society, becoming parasites, sometimes referred to as “useless eaters.” They exist by transferring money (blood money) from the host (productive taxpayers), as they produce nothing of value. Some may temporarily find themselves in this category due to no fault of their own, and some may spend their entire lives dwelling on the fruits of the welfare state being propped up to a middle-class standard of living.

Tens of millions up to 2021, and another 10 million immigrants from around the world have heard about the benefits of the welfare state, a system in which the government provides financial aid to individuals or groups who cannot support themselves. They arrive to claim their unearned monthly checks 70% of all illegal immigrants (30 million and rising) apply for and remain on welfare and Medicaid. Elderly illegal immigrants can immediately apply for Social Security and be approved while never paying a penny into the fund. A non-participating beneficiary of Social Security is just another form of welfare.

Thirty-five percent of the U.S. Population remains on welfare (115,000,000), serving as a lifeline. This is the lifeline for these individuals. However, this reliance can become a drag on the country’s economic engine. We now live in a society where the average zombie spends 8 hours on the couch watching television or online activities, gorging on fast food, and consuming all that is possible without effort. They are easily swayed and take any ideological side that the mainstream media spoon-feeds them.

The administrative state: Government employees

U.S. labor force: The private enterprise labor force is the backbone of the economy. The current participation rate is 60%, and the current employment level is approximately 161.5 million workers.

In 2022, the U.S. employment rate stood at 60 percent. Employed persons consist of persons who did any work for pay or profit during the survey reference week; persons who did at least 15 hours of unpaid work in a family-operated enterprise; and persons who were temporarily absent from their regular jobs because of illness, vacation, bad weather, industrial dispute, or various personal reasons. The employment-population ratio represents the proportion of the civilian noninstitutionalized employed population.

People not in the workforce:

Approximately 102 million people are considered not in the workforce. The workforce comprises both employed and unemployed individuals. Many unemployed people who quit looking for a job for 30 days are not counted as unemployed but rather as a sub-category called “not in the labor force.” This subset includes adults attending school, retirees, and family members caring for children.

https://www.bls.gov/web/empsit/cpseea38.htm

Everything in America revolves around consumption, debt, and financialization, transferring wealth to the top tier of society.

Total consumer debt: $18.20 trillion

https://www.newyorkfed.org/microeconomics/hhdc

https://tradingeconomics.com/united-states/debt-balance-total

Total Government debt: $40 trillion and rising by $2.5 trillion per year, with no end in sight.

The total government debt in the USA is $40 trillion of on-the-books taxpayer obligations, plus $200 trillion of unfunded and underfunded future retirement costs for Social Security and medical care.

One hundred fifty-four million workers pay taxes, including those in entry-level and part-time positions. The top 20%, or 30,800,000, produce 84% of the taxes. The calculation suggests that approximately 7% of the population pays the majority of taxes. The bottom 50% pays 2%.

Financialization is increasing the size and significance of the financial sector in the overall economy—the financial industry encompasses financial markets, institutions, and financial elites. Market pricing is replaced with speculation, whereby participants buy, sell, hedge, leverage, securitize, and manipulate to drive up prices. A systematic transfer of income and wealth occurs from the actual market to the financial sector. Most speculation is conducted with extremely high leverage.

Financialization: What it is, why it matters, & What Can be done (levyinstitute.org)

Historically, finance aims to generate income and transfer wealth into productive activities to drive the economy. Profits and wealth were the motive. Financialization has replaced effective energies with marginally honest, something-for-nothing schemes or racket. Notably, “derivatives” magnify leverage, risk, and financial rewards while generating wealth for the elites. If derivatives fail, as they did in 2007-8 and 2019, the losses are dumped on the backs of the taxpaying public. acketing is an appropriate term.

Financialization blew up in 2019 when a system known as the reverse repo market collapsed. Banks and other financial institutions lend to each other on a short-term basis in the reverse repo market, typically overnight, to provide the necessary liquidity. However, when the market froze, the Fed had to print $9 trillion to bail out the banks and provide the required liquidity. The debt became an obligation of the taxpayers.

Due to financialization, many observers believe another blowup is possible. A stock market crash, a bond market failure, a derivatives crash, bank insolvencies, or a dollar currency collapse could prompt the government to trigger a bail-in, as provided in the Dodd-Frank Wall Street Reform and Consumer Protection Act of 201. Banks would temporarily close and sweep depositors’ accounts, which would be lawful. Bank savers would lose access to their hard-earned savings and be given long-term, worthless IOUs or stock in the insolvent bank as the replacement asset.

When consumers deposit their money in banks, they assume their financial assets will be safely kept and guaranteed. The insolvent FDIC insurance fund will not be there to help. However, depositing money in the bank is one of the riskiest financial decisions. Your money in the bank’s balance sheet is listed as an unsecured creditor. When a bank fails, unsecured creditors are typically the last to recover their funds.

High-risk derivatives are off-balance-sheet hedging bets, contingent assets, or liabilities not reflected on balance sheets. If the bank fails, the undisclosed derivatives will still take precedence over the bank’s customers.

https://www.usbanklocations.com/bank-rank/derivatives.html

Issuance of money constitutes a Ponzi scheme:

When the government, as the current administration is doing now, announces a bold executive action to borrow from the future on behalf of clean energy, climate change, or to pay for COVID injections, the result is often about spending the handy, free fiat currency that the government creates out of thin air and redistributing taxpayer dollars. Out of 100% of the dollars that the government spends, 60% of it is made from thin air, and 40% is collected from taxpayers. Most folks do not understand this statement. Only 50 years ago, the government created only 25% of the money out of fiat and taxed the remaining 75%. Today’s irresponsible actions by the government can only lead to massive inflation and a corresponding decline in the purchasing power of each dollar.

The plan for all clean energy projects is to line up the pockets of labor unions that do the work and the public employees who oversee the processes. Climate change bills, such as "Building Back Better,” clean energy initiatives, and retrofitting hundreds of thousands of homes in low-income communities will do little or nothing for those responsible individuals who pay taxes, have families, and try to be self-sufficient.

Famous people often portray themselves as experts simply because they have access to mainstream media or a government presence that lends credibility. Real experts, however, cannot always command the press to pay attention to them, even if they possess a high level of expertise in their field.

Here are some comments from renowned financial experts published in the media just before the onset of the 2007 economic meltdown.

Ben Bernanke, Chairman of the Federal Reserve, said in June 2007 about the subprime fallout, “It will not affect the economy overall.”

Henry Paulson, US Treasury Secretary, “I don’t think (the subprime mess) poses any threat to the overall economy.”

Here are a few comments from famous financial experts after the crash of 2007:

Warren Buffett, the chairman and CEO of Berkshire Hathaway, Inc., said, “Very, very few people could appreciate the bubble,” which he called “a mass delusion” shared by “300 million people.”

Lloyd Blankfein, the chairman and CEO of Gold Sachs Group, Inc., likened the financial crisis to a hurricane.

Ben Bernanke, the chairman of the Federal Reserve Board since 2006, told the commission that this was a “perfect storm.”

Alan Greenspan was the Federal Reserve chairman two decades before the crash. "History tells us (regulators) cannot identify the timing of a crisis or expect exactly where it will be located or how large the losses and spillover will be.”

Henry Paulson, US Treasury Secretary, said, “We are going through a more severe and unpredictable financial crisis than any in our lifetimes.”

Why do we, in the general population, listen so obediently to so-called experts? Should we follow and trust their knowledge unquestioningly into the light? Could the “experts” tell us what we need to hear to save us from ourselves? Rational thinking suggests that, with their guidance, we should avoid potential market reactions that could lead to a mass exit from all forms of financial assets.

Let’s review what occurred in a timeline starting in early 2007.

February 2007: The single-family subprime market suffers from rising default rates.

March 2007: Home Lender New Century ceases operations.

May 2007: The Dow Jones Industrial Average hits a record high, closing above 12,000.

August 2007:

- Greenpoint Mortgage, a single-family subprime lender, ceases originating home loans.

- The Federal Government bailed out big banks with $38 billion.

- The Dow fell amid global credit market worries, sparking a broad sell-off in stocks.s

- Bank of America invests $2 billion into Countrywide Home Loans.

September 2007: The leading home lender, Impac Mortgage, ceases lending operations.

October 2007: Bank of America ceases wholesale home mortgage lending.

November 2007:The Federal Reserve injects $41 billion into U.S. Money Markets.

December 2007:

oFederal Reserve injects another $40 billion into the U.S. money supply.

Washington Mutual Bank, the most significant savings and loan in the U.S., ceases subprime home lending.

The U.S. is officially in recession.

The collapse of the subprime real estate lending market marked the beginning of the meltdown. Like the match that started the fire, massive damage occurred due to derivative losses. To further understand this, read the article "Financial Weapons of Mass Destruction--The Derivative Impact on Bank Deposits and the Death of FDIC Insurance Protection.” You can find it on my website, danharkey.com, under the Business & Finance section.

A derivative contract is a security instrument that derives its value from hedging bets between multiple assets. There is a winner and a loser based on broad, sweeping financial movements of the assets. It consists of numerous parties and counter entities, betting that something will or will not occur. In banking, it is a contract whose value is based on underlying financial assets, such as bonds, commodities, and currencies, with parties betting on specific movements and results, all of which are interest rate-sensitive.

If interest rates move up quickly or downside volatility in the financial markets occurs, defaults on derivative contracts may occur rapidly. This is precisely what happened at the onset of the 2007 meltdown. Viable and successful companies became insolvent almost overnight. The Federal Reserve allowed banks and financial companies to borrow virtually unlimited amounts to prevent a bank run. The same companies were permitted to transfer bad assets to the Federal Reserve. The Fed created the money out of thin air and then loaned it to insolvent financial institutions. This was done to avoid a default by the financial institutions that held cash in various financial instruments on behalf of the public. If the public were blocked from accessing their money in banks and financial institutions, all hell would have broken loose.

As of January 2007, the national direct debt was $5.662 trillion. As we approach the end of 2018, the global economy is estimated to be approximately $21 trillion. Much of this increase was attributed to government bailouts of private and public corporations that had become insolvent. Many companies received trillions of dollars in bailouts, with high-fives exchanged at corporate parties and additional funds distributed to employees through large bonuses. The public taxpayer is now stuck with the bill. This debt can only be paid by erasing the dollar’s purchasing power. The general taxpayer suffers the consequence of higher prices for goods and services.

What has changed, if anything? The total outstanding notional derivatives contracts in 2007 were about $ 600 trillion worldwide. Today, the total number of complete notarial contracts worldwide is approximately $596 trillion.

Today, there is significant volatility in global markets. eEBT will likely be the catalyst that triggers the next economic crisis sometime in the future. All forms of debt consist of direct and indirect debt of 280 trillion worldwide and 210 trillion in pension-related liabilities that the government(s) cannot possibly fund. All forms of borrowing create debt for consumers, corporations, students, and sovereigns, as well as unfunded and underfunded retirement and social safety net promises, which amount to approximately $500 trillionillioninterest rates rise, there will be a natural point of no return where borrowers/debtors in all forms cannot sustain their debt load/service, and defaults will spread far and wide. Debt default(s) will be the catalyst, but derivative defaults will be the financial atomic destruction device.

Would you happen to know why we should worry? The feds will bail out the risk-taking corporations and dump the result on the taxpayers again. The Fed does not have to worry about protecting the public’s access to their checking, savings, and other financial instruments. Under a provision of Dodd-Frank, there is a sweet provision that makes your checking, savings, and the safety of all financial instruments subordinated to derivative losses. Many people do not understand this and even refuse to believe it. The banks can close their doors for an extended holiday if another systemic meltdown occurs. Derivative losses must be covered before you gain access to your money. You can receive stock in the insolvent entity or your proceeds back over 30 years or some other statutory agreed date.

Having money in the bank is not all that it is trumped up to be. Those with checking and savings accounts may find themselves vulnerable to the “Wimpy” of the world. Will the government gladly pay you next Tuesday for the new money created today? The Federal Reserve is responsible for developing new money. The government decides how to spend it, which will result in a corresponding debt that will never be repaid. There was a good reason: the diner proprietor, Popeye’s, rejected Wimpy’s request because he had a reputation for never paying back his debt.s